Welcome to Your Digital Transformation Journey with Harfin Solutions

Harfin Solutions Private Limited is a trusted financial services company in India with 10+ years of expertise, delivering innovative and reliable finance solutions for businesses.

About Harfin Solutions PVT LTD

At Harfin Solutions, we have been providing expert financial solutions for 15 years and have helped countless clients secure their financial futures. Our services include investment planning, insurance and protection planning, and higher education planning.

Our experienced portfolio managers will work with you to understand your financial goals and create a customized plan to help you achieve them. Whether you’re looking to grow your wealth, protect your family, or plan for your children’s education, we have the knowledge and expertise to guide you.

We offer a wide range of products to meet your financial needs, including bonds, mutual funds, SIPs, fixed deposits, and life insurance saving plans. Our goal is to provide you with the right tools and resources to help you reach your financial objectives.

At Harfin Solutions, our top priority is helping you achieve financial success. Contact us today to schedule a consultation with one of our knowledgeable portfolio managers. Let us help you secure your financial future.

Our Offerings

Retirement Fund Management

We provide expert guidance and support in managing your funds after retirement.

Children's Higher Education Planning

We help plan for your children's higher education, ensuring their future is financially secure.

Corporate Health Insurance

We offer comprehensive corporate health insurance solutions to protect your employees and your business.

NBFC FDs & Corporate Bonds

We offer a range of investment options, including fixed deposits with NBFCs and corporate bonds, to help you meet your financial goals.

Products Offered

Corporate & Govt Bonds

- Corporate Bonds

- Government Bonds

Mutual Funds

- Long Term Mutual Funds

- Solutions Oriented Schemes

SIPs

- Systematic Investment Plans

NBFC FD's

- Fixed Deposits

Life Insurance Saving Plans

- Life Insurance

Corporate Health Insurance

- Health Insurance

Tips for Managing Funds After Retirement

Here are some tips to help you manage your finances effectively post-retirement.

Create a Budget

Start by tracking your expenses and creating a budget that works for you. This will help you stay within your means and make the most of your retirement funds.

Focus on Steady Income

Prioritize generating regular income through investments or other sources to support your lifestyle post-retirement.

Prioritize Spending

Evaluate your spending habits and prioritize the expenses that are most important to you. Cut back on unnecessary expenses to maximize your funds.

Secure Financial Health with Health Insurance

Healthcare costs can be a significant burden, so ensure you have adequate health insurance coverage to safeguard your financial security.

Stay Tax-Efficient

Stay informed about tax laws and regulations and take steps to minimize your tax burden.

Monitor Your Retirement Plan

Regularly assess your retirement plan and make adjustments if needed to ensure its effectiveness and longevity.

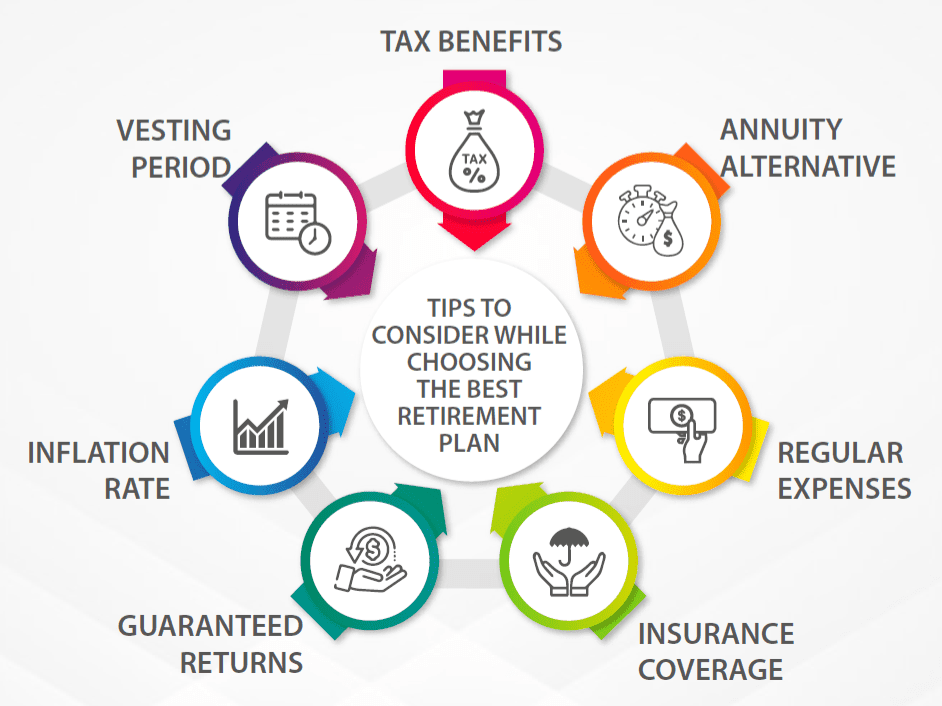

Tips to Consider While Choosing the Best Retirement Plan

Planning for retirement is one of the most important financial decisions of your life. A well-chosen retirement plan not only secures your future but also provides peace of mind. Here are some key factors you should consider before selecting the right plan.

🔹 Tax Benefits

🔹 Annuity Alternative

🔹 Regular Expenses

🔹 Insurance Coverage

🔹 Guaranteed Returns

🔹 Inflation Rate

🔹 Vesting Period

THE FINANCIAL WELL-BEING:

A Financial Literacy Initiative

by HARFIN SOLUTION

About Harfin Solutions, we have been providing expert financial solutions for 15 years and have helped countless clients secure their financial futures. Our services include investment planning, insurance, and protection planning and higher education planning our Financial Literacy Initiatives...

Managing funds after retirement can be a daunting task, but with the right strategies in place, you can ensure financial stability and peace of mind.

Our Three Pillar Strategy

Want To Run An Independent & Successful Financial Business?

Join us as Associate Business Partner (ABP)

- Training and support provided

- Make handsome income monthly

- Wide range of financial products to sell

- Zero joining fees

- No office space required

Our Partner Companies